-

Blockbuster! Sinopec signed a deal with Saudi Aramco.03 10,2022

Blockbuster! Sinopec signed a deal with Saudi Aramco.03 10,2022On March 8, Chinese Petrochemical Corporation (SINOPEC) and Saudi Arabian Petroleum Corporation (Saudi Aramco) signed a Memorandum of Understanding (" MOU "). According to the memorandum, the scope of cooperation includes sinopec's existing refining and chemical projects and future expansion projects, and the two sides will give full play to their advantages to further strengthen the long-term cooperative relationship. The two sides will also work together to optimize the operation of their joint venture Fujian United Petrochemical Co. LTD. (" Fujian United Petrochemical "). It is understood that sinopec and Saudi Aramco currently have three joint ventures, namely Fujian Union Petrochemical In China, Sinopec Senmei (Fujian) Petroleum Company, and Yanbu Aramco Sinopec Refining Company in Saudi Arabia. The cooperation projects between the two countries include crude oil trade, refining and chemical industry, engineering services and technological research and development. The two countries enjoy a good strategic partnership, and a number of projects jointly implemented have become models of energy cooperation between China and Saudi Arabia. In the context of accelerating global energy transition, the signing of the MOU will provide new opportunities to further deepen and expand the feedstock optimization and downstream petrochemical business development of China's petrochemical refineries. Mohammed Y. Al Qahtani, Senior vice president of Downstream business at Saudi Aramco, said the signing of the MOU is a new chapter in the long-term partnership between Saudi Aramco and Sinopec. This will further facilitate the consolidation and expansion of Saudi Aramco's downstream business in Asia to meet China's growing energy needs by providing low carbon intensity crude oil.

-

South Korea's YNCC hit by fatal Yeosu cracker explosion02 11,2022

South Korea's YNCC hit by fatal Yeosu cracker explosion02 11,2022Shanghai, 11 February (Argus) — South Korean petrochemical producer YNCC's No.3 naphtha cracker at its Yeosu complex suffered an explosion today that killed four workers. The 9.26am (12:26 GMT) incident resulted in another four workers hospitalized with serious or minor injuries, according to fire department authorities. YNCC had been carrying out tests on a heat exchanger at the cracker following maintenance. The No.3 cracker produces 500,000 t/yr of ethylene and 270,000 t/yr of propylene at full production capacity. YNCC also operates two other crackers at Yeosu, the 900,000 t/yr No.1 and 880,000 t/yr No.2. Their operations have unaffected by today's explosion. YNCC is a joint venture between South Korean firms Hanwha Solutions and Daelim Industrial.

-

A brief analysis of China's PP import and export in 202101 29,2022

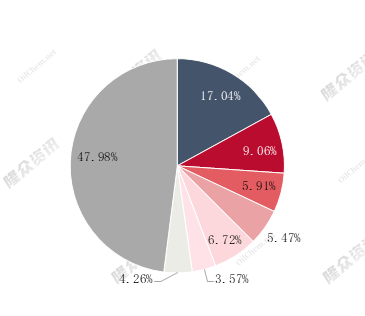

A brief analysis of China's PP import and export in 202101 29,2022A brief analysis of China's polypropylene import and export in 2021 In 2021, China's polypropylene import and export volume changed greatly. Especially in the case of the rapid increase in domestic production capacity and output in 2021, the import volume will drop sharply and the export volume will rise sharply. 1. The import volume has dropped by a wide margin Figure 1 Comparison of polypropylene imports in 2021 微信图片_20220214150129.png According to customs statistics, polypropylene imports totally in 2021 reach 4,798,100 tons, down 26.8% from 6,555,200 tons in 2020, with an average annual import price of $1,311.59 per ton. Among them, 3,179,900 tons of primary shape polypropylene, 1,434,500 tons of ethylene-propylene polymers, and 183,700 tons of other primary shapes of propylene copolymers. From February to March 2021, the extremely cold weather in Europe and the United States caused supply disruptions, overseas PP offers rose, import profits were compressed, and import volumes fell sharply. In addition, the price of sea freight increased during the year, and the import cost increased. Domestic PP has a price advantage, and the import window Long-term closure, China's polypropylene imports will shrink by 26.8% in 2021. Figure 2 Analysis of the proportion of China's polypropylene import source countries in 2021 微信图片_222.png China's polypropylene import sources are relatively concentrated. According to customs import data statistics, the top three sources of polypropylene imports in Chinamainland in 2021 are South Korea, Singapore, and Taiwan, China, with import volumes of 1.1332 million tons, 766,400 tons, and 605,000 tons respectively. ton, accounting for 23.62%, 15.97%, and 12.61% of the total import volume, respectively. The top three sources of polypropylene imports in 2020 are South Korea, Singapore, and Taiwan, China, which is consistent with 2021 and has a stable structure. 2. The export volume rose sharply Figure 3 Comparison of polypropylene exports in 2021 微信图片333.png According to customs statistics, the total export volume of polypropylene in my country in 2021 will be 1,391,100 tons, an increase of 227.24% from 425,100 tons in 2020, and the average annual export price is 1,535.02 US dollars / ton. Among them, 1,274,200 tons of polypropylene in primary shape, 98,500 tons of ethylene-propylene polymers, and 183,700 tons of propylene copolymers in other primary shapes. In 2021, the export volume has reached 1.3911 million tons, a record high. In recent years, domestic polypropylene production capacity has been continuously expanding. In this context, the pressure of market supply and demand has gradually become prominent, and the opening of the export market can better balance the relationship between supply and demand. Based on this, major petrochemical companies, CNPC and large traders have been actively To open up export channels and achieve certain results, in addition, in order to improve international competitiveness and encourage exports, the country has formulated an export tax rebate system, and 13% of polypropylene export taxes can be refunded. The price is more competitive, the export arbitrage window is opened from time to time, and the export volume is increasing year by year; in February 2021, the extreme cold weather occurred in the United States, which forced the closure of its domestic polyolefin plants. The rare situation lasted until October, creating a good opportunity for my country's polypropylene export. Domestic traders tried to export one after another, and the export volume increased significantly during the year. Figure 4 Analysis of the proportion of China's polypropylene export source countries in 2021 444.png In 2021, China's polypropylene export production and sales countries changed. According to customs export data statistics, the top three polypropylene export production and sales countries in my country in 2021 are Vietnam, India, and Bangladesh, with export volumes of 237,000 tons, 126,000 tons, 93,500 tons, accounting for 17.04%, 9.06%, and 6.72% of the total export volume, respectively. Compared with 2020, the changes have changed a lot. The top three polypropylene export producing and selling countries in 2020 are Vietnam, Hong Kong, China, and Japan. Under the influence of emergencies in 2021, the international supply and demand pattern will undergo a short-term change, China will gain greater export opportunities, and the scope of domestic polypropylene production and sales will expand and the number will increase.

-

PP Annual Events of 2021 !12 19,2021

PP Annual Events of 2021 !12 19,20212021 PP Annual Events 1. Fujian Meide Petrochemical PDH Phase I Project was successfully put into operation and produced qualified propylene products On January 30, the 660,000-ton/year propane dehydrogenation phase I of Fujian Zhongjing Petrochemical's upstream Meide Petrochemical successfully produced qualified propylene products. The status quo of external mining of propylene, the upstream industrial chain has been improved. 2. The United States has encountered extreme cold in a century, and the high price of the US dollar has led to the opening of the export window In February, the United States encountered extremely cold weather, which was once in a century, causing the local polypropylene plant to be shut down. The price of the US dollar market rose, and the domestic polypropylene price became a depression. The export window was opened significantly in the first quarter. 3. In the post-epidemic era, the demand for non-woven fabrics has fallen, and PP fiber materials are difficult to meet the market last year In 2020, due to the impact of the public health incident, the demand for non-woven fabrics will increase significantly, which will drive the price of fiber materials to strengthen. Entering 2021, in the post-epidemic era, the non-woven fabric industry will no longer expand its capacity, and the elimination of backward production capacity will lead to industrial concentration. The demand for PP fiber material is becoming more and more stable, and the price cannot reflect the obvious advantage. 4. In the second quarter, the centralized production of polypropylene will increase the supply pressure In April, Tianjin Petrochemical’s 200,000 tons/year, Donghua Ningbo Phase II 800,000 tons/year, and Sino-Korea Petrochemical’s 300,000-ton/year polypropylene units were released in the second quarter. The unprecedented supply pressure in the market suppressed the market. mentality. 5. The cost pressure of the downstream washing machine industry is increasing, and the performance of the PP copolymer market is sluggish According to data from the National Bureau of Statistics, the output of domestic washing machines in my country has reached 36.199 million units from January to May 2021. From the monthly data, the output of washing machines has shown a downward trend month by month, and the alarm bell of weaker demand has sounded. For polypropylene copolymerization The market had a significant impact. 6. The production capacity continues to be released, and the market mentality is becoming more and more sluggish At 16:30 on August 18, 2021, the 300,000-ton/year high-performance polypropylene plant of Liaoyang Petrochemical Company was successfully put into operation and produced qualified products. At 1:16 p.m. on August 17th, the largest petrochemical project jointly owned by both sides of the Taiwan Strait - Fujian Zhangzhou Gulei Refinery and Chemical Integration Project's ethylene unit cracking furnace was put into charge. The two sets of devices released production capacity in a concentrated manner, and the market's pessimistic expectations increased. 7. The implementation of the dual-control policy on energy consumption resulted in a significant increase in PP costs Entering the third quarter, the energy consumption results of various provinces were released. After the energy consumption policy was introduced, the panic in the black market intensified. The rise in coal prices drove the price of polypropylene to skyrocket, and the profit from coal-to-olefins suffered varying degrees of loss. 8. Power curtailment and power policy adjustments have led to a decline in the start-up of the polypropylene downstream industry On September 16, the National Development and Reform Commission issued the "Plan for Improving the Dual Control System of Energy Consumption Intensity and Total Volume". In addition, facing the pressure of the "dual control" assessment at the end of the quarter, Guangdong, Zhejiang, Jiangsu, Shandong and other places have successively issued power cuts from late September. , production restriction policy. Downstream enterprises' off-peak production, orderly electricity consumption, and "one-size-fits-all" power cuts have attracted market attention. 9. The five major raw materials of polypropylene have entered a state of comprehensive loss In November, the prices of imported raw materials propane and crude oil soared, coupled with the high domestic black prices, all the five major sources of polypropylene raw materials suffered losses to varying degrees, but demand was also sluggish, so the market continued to fluctuate. 10. The trend of policy orientation changes the cost and profit of coal-based PP On October 20, the National Standing Committee clearly stated that it will crack down on speculation in the coal market in accordance with the law. At the same time, the National Development and Reform Commission issued three articles on October 19 stating that it will take all measures to intervene in coal prices in accordance with the law. As a result, coal prices have fallen, coal-to-olefins cost pressure has been eased, and profits have been restored.