-

Alpha-olefins, polyalpha-olefins, metallocene polyethylene!09 22,2022

Alpha-olefins, polyalpha-olefins, metallocene polyethylene!09 22,2022On September 13, CNOOC and Shell Huizhou Phase III Ethylene Project (referred to as Phase III Ethylene Project) signed a "cloud contract" in China and the United Kingdom. CNOOC and Shell respectively signed contracts with CNOOC Petrochemical Engineering Co., Ltd., Shell Nanhai Private Co., Ltd. and Shell (China) Co., Ltd. signed three agreements: Construction Service Agreement (CSA), Technology License Agreement (TLA) and Cost Recovery Agreement (CRA), marking the start of the overall design phase of the Phase III ethylene project. Zhou Liwei, member of the CNOOC Party Group, Deputy General Manager and Secretary of the Party Committee and Chairman of CNOOC Refinery, and Hai Bo, member of the Executive Committee of Shell Group and President of Downstream Business, attended and witnessed the signing. The third-phase ethylene project adds 1.6 million tons/year of ethylene capacity on the basis of the 2.2 million tons/year ethylene production capacity of the first and second phase projects of CNOOC Shell. It will produce chemical products with high added value, high differentiation and high competitiveness to meet the market shortage and development needs of high-performance new chemical materials and high-end chemicals in the Greater Bay Area, and inject strong impetus into the construction of the Guangdong-Hong Kong-Macao Greater Bay Area . The third phase of the ethylene project will realize the first application of alpha-olefin, polyalpha-olefin and metallocene polyethylene technologies in the Asia-Pacific region. With the help of the world's cutting-edge technologies, the product structure will be further enriched and the transformation and upgrading will be accelerated. The project will continue to apply and improve the new model of international cooperation management, set up an integrated management team, speed up project construction, and build a world-class green petrochemical industry highland with global competitiveness.

-

The domestic paste resin market fluctuated downward.09 20,2022

The domestic paste resin market fluctuated downward.09 20,2022After the Mid-Autumn Festival holiday, the early shutdown and maintenance equipment resumed production, and the domestic paste resin market supply has increased. Although the downstream construction has improved compared with the previous period, the export of its own products is not good, and the enthusiasm for the purchase of paste resin is limited, resulting in paste resin. Market conditions continued to decline. In the first ten days of August, due to the increase in export orders and the failure of mainstream production enterprises, domestic paste resin manufacturers have raised their ex-factory quotations, and downstream purchases have been active, resulting in a tight supply of individual brands, which has promoted the continuous recovery of the domestic paste resin market. East China, South China and other major consumption areas High-end offer prices all exceeded 9,000 yuan / ton. After entering September, although the maintenance of paste resin enterprises is still relatively concentrated, the downstream has entered the Mid-Autumn Festival to stop work one after another, the market demand for paste resin has further shrunk, the market has fallen from high fluctuations, and downstream factories are mainly buying on dips. After the Mid-Autumn Festival, there was a significant increase in downstream construction, but the supply of goods for centralized procurement in the early stage was still not fully digested, and the enthusiasm for procurement was not high. In addition, according to some downstream factories, due to the severe inflation in Europe and North America, this year's Christmas orders have been delayed compared with previous years, and some completed orders have been requested by importers to delay delivery, which has caused storage and capital of domestic processing enterprises. greater pressure.

-

ExxonMobil Huizhou ethylene project starts construction of 500,000 tons/year LDP09 16,2022

ExxonMobil Huizhou ethylene project starts construction of 500,000 tons/year LDP09 16,2022In November 2021, ExxonMobil Huizhou ethylene project held a full-scale construction activity, marking the entry of the project's production unit into the full-scale formal construction stage. ExxonMobil Huizhou Ethylene Project is one of the first seven major landmark foreign-funded projects in the country, and it is also the first major petrochemical project wholly-owned by an American company in China. The first phase is planned to be completed and put into operation in 2024. The project is located in Daya Bay Petrochemical Zone, Huizhou. The total investment of the project is about 10 billion US dollars, and the overall construction is divided into two phases. The first phase of the project includes a flexible feed steam cracking unit with an annual output of 1.6 million tons of ethylene, two sets of high-performance linear low-density polyethylene units with a total annual output of 1.2 million tons, and a low-density polyethylene unit with an annual output of 500,000 tons of the world's largest monomer. Density polyethylene plant and two sets of differentiated high-performance polypropylene plants with an annual output of 950,000 tons, as well as a number of supporting projects such as heavy-duty terminals. After the first phase of the project is put into production, it is expected to achieve an operating income of 39 billion yuan per year. It is planned that while the first phase of the project is completed and put into production, the second phase of the project will be started. In March 2022, ExxonMobil Huizhou Ethylene Project (Phase I) increased its investment by US$2.397 billion, and the total investment in the first phase of the project increased to US$6.34 billion. Nanjing Engineering Company has undertaken seven main construction general contracting tasks, including a 270,000-ton/year butadiene extraction unit, a 500,000-ton/year high-pressure low-density polyethylene unit, and a boiler unit. The 500,000-ton/year LDPE plant is the world's largest single-unit low-density polyethylene plant. The reaction dam requires extremely high construction accuracy, imported compressors have high installation standards, and the pressure of high-pressure and ultra-high-pressure pipelines reaches 360 MPa. It is the first cooperation between Nanjing Engineering Company. Contracted low density polyethylene plant.

-

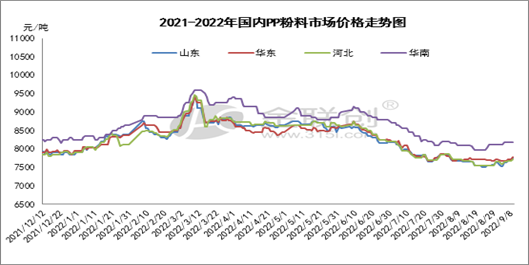

The peak season starts, and the PP powder market trend is worth looking forward09 13,2022

The peak season starts, and the PP powder market trend is worth looking forward09 13,2022Since the beginning of 2022, restricted by various unfavorable factors, the PP powder market has been overwhelmed. The market price has been declining since May, and the powder industry is under great pressure. However, with the advent of the "Golden Nine" peak season, the strong trend of PP futures boosted the spot market to a certain extent. In addition, the rise in the price of propylene monomer gave strong support for powder materials, and businessmen's mentality improved, and the powder material market prices began to rise. So can the market price continue to be strong in the later stage, and is the market trend worth looking forward to? In terms of demand: In September, the average operating rate of the plastic weaving industry has mainly increased, and the average operating rate of domestic plastic weaving is about 41%. The main reason is that as the high temperature weather recedes, the influence of the power curtailment policy has weakened, and with the advent of the peak season of plastic weaving demand, the overall orders of the plastic weaving industry have improved compared with the previous period, which has increased the enthusiasm of the plastic weaving industry to start construction to a certain extent. And now that the holiday is approaching, the downstream is properly replenished, which drives the trading atmosphere of the powder market to pick up, and supports the powder market offer to a certain extent. Supply: At present, there are many parking devices in the polypropylene powder yard. Guangqing Plastic Industry, Zibo Nuohong, Zibo Yuanshun, Liaohe Petrochemical and other manufacturers that have parked in the early stage have not restarted construction at present, and the current price of propylene monomer is relatively strong. The price difference between propylene monomer and powder material has further narrowed, and the profit pressure of powder material enterprises has increased. Therefore, the overall operating rate of the powder industry is mainly operating at a low level, and there is no supply pressure in the field to temporarily support the powder market offer. In terms of cost: the recent international crude oil prices were mixed, but the overall trend was weak and fell sharply. However, the start-up of propylene monomer production units that were expected to be restarted in the early stage was delayed, and the commissioning of some new units in Shandong was suspended. In addition, the supply of goods from the northwest and northeast regions decreased, the overall supply and demand pressure was controllable, the market fundamentals were positive factors, and the propylene market price rose strongly. Push, giving strong support for powder costs. To sum up, it is expected that the market price of polypropylene powder will mainly rise in September, and there is an expectation of recovery, which is worth looking forward to.